Posted on May 23, 2019 by Wendy Frost

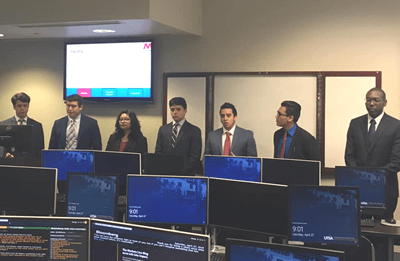

Eight sector teams comprised of 28 senior and junior analysts presented their stock-screening model to a panel of experienced portfolio managers. The teams were graded on model organization and sophistication, clarify of explanation, team participation and model innovation and uniqueness.

This year’s winning team was the Consumer Staples team led by senior analysts Rachid Assad and Jill Kuchler and junior analysts Lauren Francis and Albert Morales.

“Winning the Sector Wars was an incredible experience,” said Asad, a sophomore majoring in finance in the College of Business. “From building a stock-screening model on a particular sector to ultimately presenting in front of a CFA audience, the overall experience gave me a set of skills that employers in the industry value.”

“This was the strongest competition we’ve had yet,” said Ron Sweet, MBA ’91, advisor to the Investment Society and lecturer II in finance. “There were several teams that could have won this year. All of the teams did well, and the quality of the research, analysis and presentations was exceptional.”

The Investment Society is a student organization that provides UTSA students with real-world experience in finance and investing. Investment Society members manage a stock portfolio that mirrors an actual portfolio created by Sweet to fund charitable work in Costa Rica.

Working on the student stock portfolio is open to all UTSA undergraduate and graduate students. At the beginning of each academic year, students are broken into eight to 10 Sector Teams, each led by a senior analyst and supported by junior analysts.

The top three teams were Consumer Stables, Technology and Energy. “I had an amazing time leading a sector and building relationships with the other analysts,” said John Peter Desmet, a junior majoring in mechanical engineering who led the Technology Team. “I learned so much about financial markets, especially the tech sector and the analysis that goes into them. I came in, never having taken a finance class, and finished the semester as one of the top three sectors.”

“The students’ presentations were superb and thought provoking. Most impressively, I came away convinced that a few of the stock recommendations warranted consideration for the institutional equity portfolios that I help manage,” said John Toohey, vice president and head of equities at USAA. “The students deserve plaudits for performing professional-level analysis and synthesizing vast amounts of quantitative and qualitative information into clear and concise conclusions. They have bright futures ahead of them in the investment world.”